Remember the new world of financial opportunity that opened the day you turned 18? You could apply for a credit card. You could be approved for tens (or hundreds) of thousands of dollars in student loans. You could rent your own apartment.

And since you took a personal finance course in high school, you knew how to budget for it all, right?

Oh, wait.

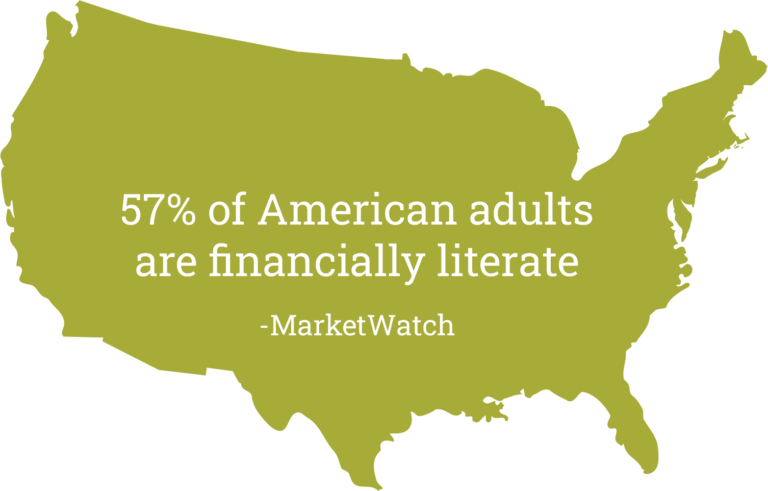

It turns out only 25 states — exactly half — require high school students to complete at least one semester of personal finance. And the consequences bear that out.

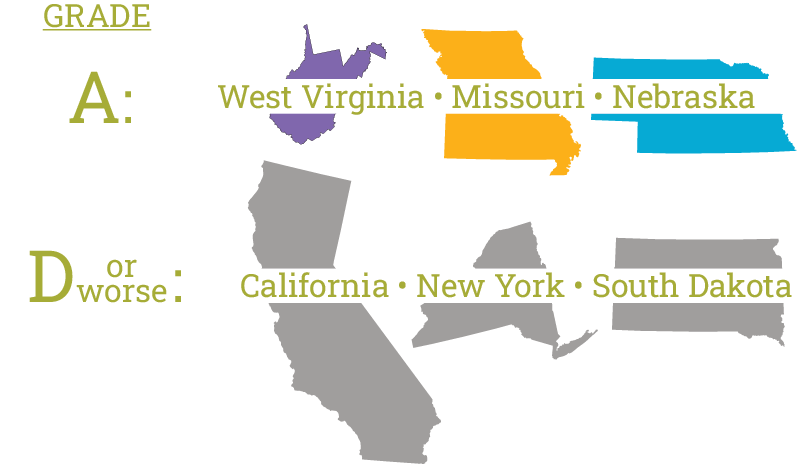

What’s more, the grades given by The Nation’s Report Card which rates each state’s financial literacy requirements, contain some surprising results.

And what the average American doesn’t know costs them around $1,500 per year due to poor budgeting, overspending and interest payments.

What’s more? That lack of knowledge extends to the differences between credit unions and banks.

40%

of non-members don’t think they can join a credit union

60%

of Americans think credit unions don’t offer mortgages

71%

of non-member Millennials are not familiar with credit unions

Source: KASASA®

There is a silver lining in this, though: The right kind of marketing can attract new customers (and their deposits).

But what kind of messaging should you use? First, we need to understand what people — especially Millennials and younger — want from their financial institutions. And then we need to identify which media to use.

Let’s dig into that.

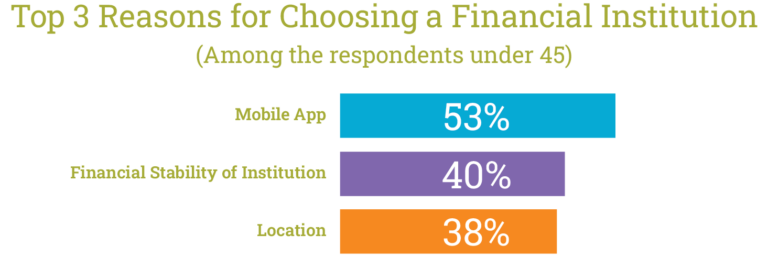

Younger People Want Anytime Access

“Bankers’ hours” might be a good thing for people who actually work at a bank (or credit union). But for the customers who want to visit a branch in-person? Not so much.

To attract new depositors, this perceived lack of convenience — and locations — presents a major concern that needs to be addressed.

In short, accessibility is paramount.

Reasons Why People Don’t Join a Credit Union

55%

believe credit unions don’t offer online banking

– Affinity FCU/Harris Poll

33%

say there aren’t enough branch locations

-Michigan Credit Union League

38%

say branch locations are inconvenient

-Michigan Credit Union League

Odds are, you offer online banking so customers can deposit checks electronically, set up bill pay, transfer money and even apply for a loan.

That may be obvious to you — but it isn’t to non-members. Positioning your company as digital and accessible will go a long way in attracting youngers customers.

Source: Sogolytics

Younger Bankers Value… Their Values

How you spend or invest your money reflects your values to a certain extent. Most of us don’t think of that with each and every purchase — our minds simply lack the bandwidth.

But every can of soup we buy, every individual stock we invest in implies we support the company that makes the products we use. And let’s be honest: Wall Street and mega banks haven’t exactly done much to endear themselves to the average American over the past couple of decades.

That has led many to migrate to financial institutions whose values align with those of common people — especially Millennials and younger.

46%

of Millennials say community involvement is an essential characteristic of the “perfect” financial institution

73%

of Millennials prefer to do business with companies that align with their values

75%

of Millennials make financial decisions based on their personal values

This means, all things being equal, would-be depositors are more likely to do business with a financial institution that tries to make life better for all.

And since credit unions are equal — if not better — in terms of fiscal service (e.g. online banking, checking and savings, etc.), leaning into community service messaging might make a difference.

Younger Depositors Value Advice

Remember how woefully inadequate our country is when it comes to financial literacy?

That affects lives in tangible ways, most obviously in the form of many not knowing how to manage their finances (at best). And mismanaging their money (at worst).

It’s no wonder, then, that younger depositors not only need advice —they want it.

Among Depositors 18-24:

Odds are, your website, app and employees can provide, at the very least, basic financial recommendations and guidance. Promoting this service, free of charge, shifts perceptions of your branch just being a place to store money to a resource that helps members be wiser with their money.

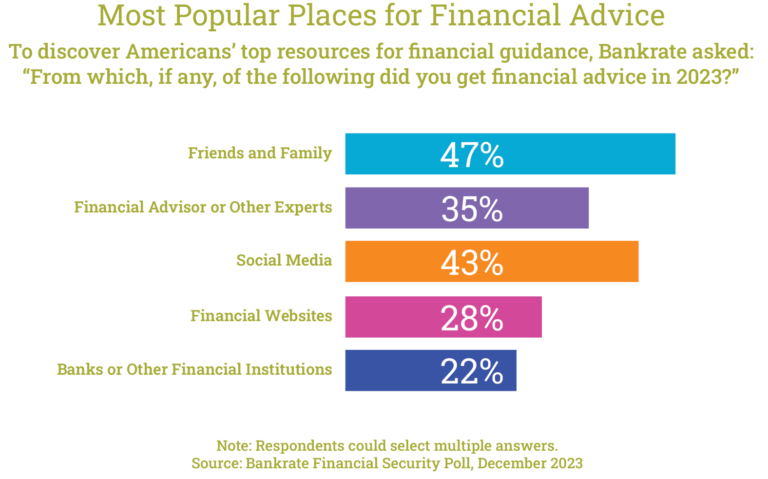

So, Where Do Millennials and Younger Turn for Financial Advice?

According to a recent Bankrate survey, resources range from in-person to print.

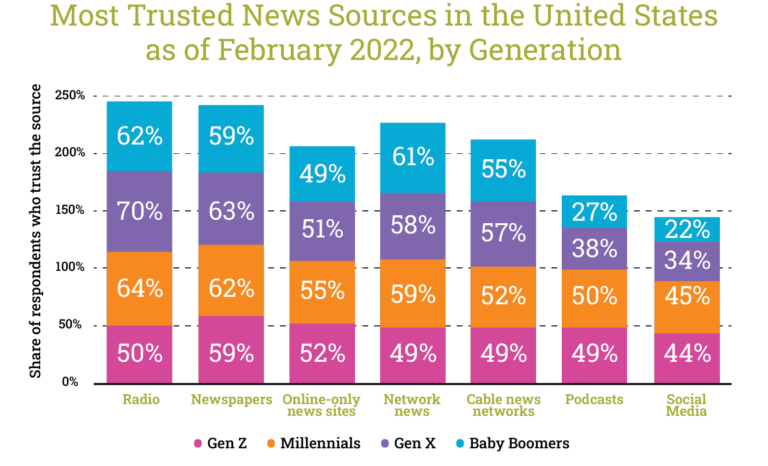

But maybe this shouldn’t come as a surprise, given how trusting (or not) different generations are of news sources.

In search engine optimization, algorithms contain hundreds of ranking factors. One of those is an abbreviation: YMYL (Your Money, Your Life). In short, sites with high levels of authority and expertise are given preference for searches pertaining to life-altering content. In this case: Your Wealth and Your Health. Actually, that sounds better than Your Money, Your Life.

Anyway, you wouldn’t ask a stranger on the street for advice on treating a rash on your arm, would you? But you would be more likely take the advice of someone your trust, like a friend or family member.

Or a content creator or forum that you’ve established a trusted connection with.

Key Takeaways

Life rarely happens in a vacuum. Targeting one audience one way produces desired ripple effects when messaging a different audience through a different medium.

For example, creating a campaign targeting Gen Xers through their preferred media that explains the “traditional” services a credit union provides could result in new customers. And those returns are potentially exponential, given that Millennials and younger ask their families for financial advice — including which financial institution to use.

Likewise, centering messaging on podcasts and social media around digital convenience, the ability to open an account online, using a non-profit financial institution, “belonging to” or “being a member” to elicit a certain exclusivity, could also help credit unions differentiate themselves in a positive light.

The Ideal Media Mix

Attracting Millennials — the largest demographic — and younger should be a priority for any financial institution. But ignoring older generations could prove costly.

Creating a media strategy, with appropriate messaging per audience, is an investment worth the effort.

Reach out and let’s discuss how Stealth Creative’s media buyers and strategists build brighter financial futures — for your credit union and your members.