Remember the new world of financial opportunity that opened the day you turned 18? You could apply for a credit card. You could be approved for tens (or hundreds) of thousands of dollars in student loans. You could rent your own apartment.

And since you took a personal finance course in high school, you knew how to budget for it all, right?

Oh, wait.

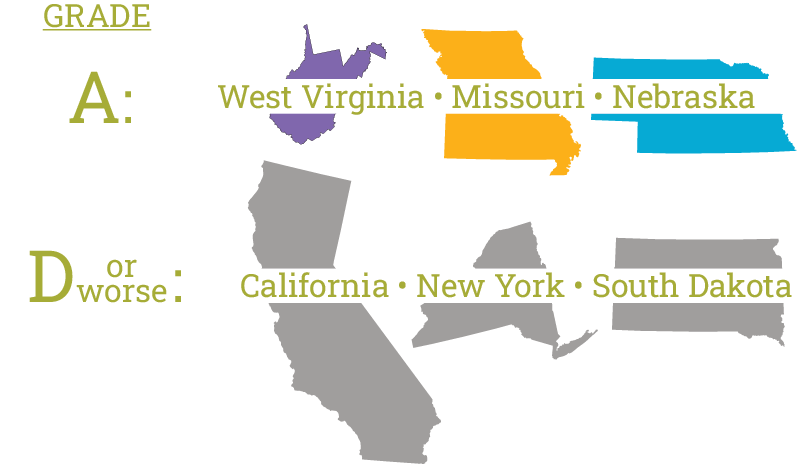

It turns out only 25 states — exactly half — require high school students to complete at least one semester of personal finance. And the consequences bear that out.

What’s more, the grades given by The Nation’s Report Card which rates each state’s financial literacy requirements, contain some surprising results.

This financial illiteracy costs the average American around $1,500 per year due to poor budgeting, overspending and interest payments!

Similarly, marketing illiteracy can cost local banks and credit unions exponentially more — we’re talking millions and millions of dollars — in terms of lost customers and deposits.

But this begs the question: What kind of messaging should you use? First, we need to understand what people — especially Millennials and younger — want from their financial institutions. And then we need to identify which media to use.

Let’s dig into that.

Younger People Want Anytime Access

“Bankers’ hours” might be a good thing for people who work at financial institutions. But for the customers who want to visit a branch in-person? Not so much.

To attract new depositors, this perceived lack of convenience — and locations — presents a major concern that needs to be addressed.

In short, accessibility is paramount.

Generational Preferences in Banking

Generation Z

76%

prefer digital banking

6%

prefer in-person banking

Millennials

86%

prefer digital banking

5%

prefer in-person banking

Generation X

62%

prefer digital banking

8%

prefer in-person banking

Baby Boomers

48%

prefer digital banking

20%

prefer in-person banking

Source: Kiplinger

That data is to be expected. But what features within online banking does each generation consider must have? The results are somewhat surprising.

Generation Z *

- Faster payments/quicker transfers

- Automated savings and investment tools

Baby Boomers **

- Simple planning tools

- Quick access to accounts and financial advice

- Personal Finance Management tool (PFM)

- Debt & investment management tools

- Quick and easy way to transfer funds

- Fraud protection

Millennials *

- Faster payments/quicker transfers

In General ***

- Mobile check deposit

- Goal trackers

- Automated Savings

- Financial calculators

- Budgeting tools

- Person-to-person payments

- Integration with mobile wallet

Sources:

*Javelin Strategy **Enterprise Bank and Trust *** Lumber Digital

Oddly enough, Boomers seem to want the most features. It could be that younger generations expect that type of functionality. Regardless, if you can tout you have technology that legitimately addresses these needs, it might make sense to make this digital-first messaging the cornerstone of a campaign — especially if you’re interested in targeting Millennials or younger.

Source: Sogolytics

Younger Bankers Value… Their Values

How you spend or invest your money reflects your values to a certain extent.

Every can of soup we buy, every individual stock we invest in implies we support the company that makes the products we use. And let’s be honest: Wall Street and mega banks haven’t exactly done much to endear themselves to the average American over the past couple of decades.

In fact, positioning your financial institution as the opposite of a mega bank could mean being viewed more favorably.

Generation Z

65%

Trust in

Local/Community Banks

45%

Trust in Mega Banks

Millennials

72%

Trust in

Local/Community Banks

50%

Trust in Mega Banks

Generation X

70%

Trust in

Local/Community Banks

55%

Trust in Mega Banks

Baby Boomers

68%

Trust in

Local/Community Banks

60%

Trust in Mega Banks

Sources: FinTech Magazine American Bankers Association Extractable

That has led many to migrate to financial institutions whose values align with theirs — especially Millennials and younger.

46%

of Millennials say community involvement is an essential characteristic of the “perfect” financial institution

73%

of Millennials prefer to do business with companies that align with their values

75%

of Millennials make financial decisions based on their personal values

This means, all things being equal, would-be depositors are more likely to do business with a financial institution that tries to make life better for all.

And since community banks and credit unions are likely equal — if not better — in terms of fiscal service (e.g. online banking, checking and savings, etc.) compared to “mega” banks, leaning into community service messaging might make a difference.

Younger Depositors Value Advice

Remember how woefully inadequate our country is when it comes to financial literacy?

That affects lives in tangible ways, most obviously in the form of many not knowing how to manage their finances (at best). And mismanaging their money (at worst).

It’s no wonder, then, that younger depositors not only need advice —they want it.

Among Depositors 18-24:

Odds are your website, app and employees can provide basic financial recommendations and guidance. Promoting this service, free of charge, shifts perceptions of your branch just being a place to store money to a resource that helps members be wiser with their money.

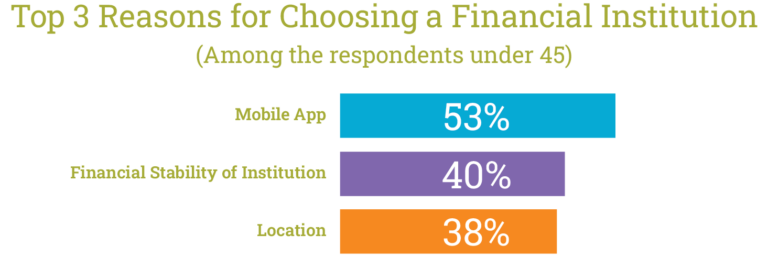

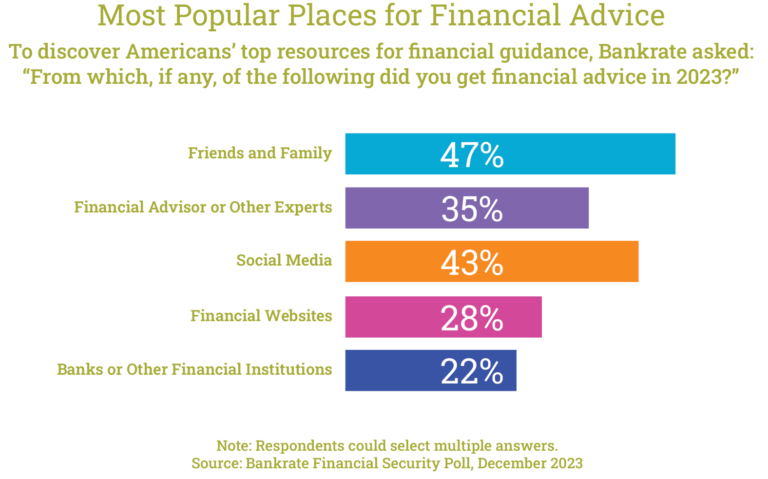

So, Where Do Millennials and Younger Turn for Financial Advice?

According to a recent Bankrate survey, resources range from in-person to print.

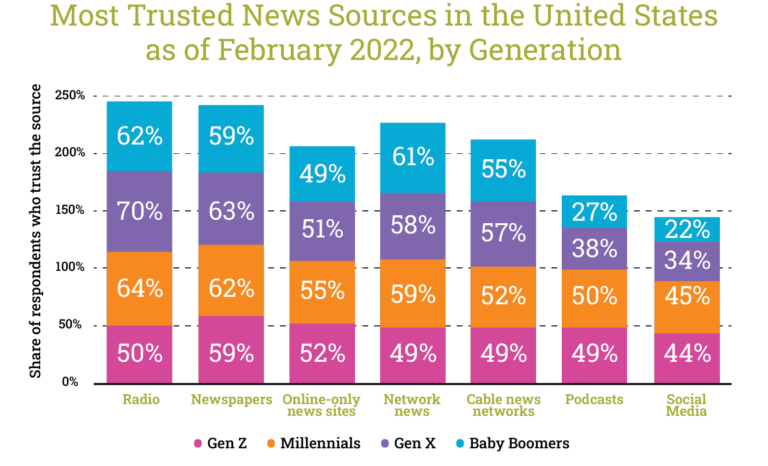

But maybe this shouldn’t come as a surprise, given how trusting (or not) different generations are of news sources.

In search engine optimization, algorithms contain hundreds of ranking factors. One of those is an abbreviation: YMYL (Your Money, Your Life). In short, sites with high levels of authority and expertise are given preference for searches pertaining to life-altering content. In this case: Your Wealth and Your Health. Actually, that sounds better than Your Money, Your Life.

Anyway, you wouldn’t ask a stranger on the street for advice on treating a rash on your arm, would you? But you would be more likely take the advice of someone your trust, like a friend or family member.

Or a content creator or forum that you’ve established a trusted connection with.

Key Takeaways

Life rarely happens in a vacuum. In this case, targeting an older audience one way can provide desired ripple effects when messaging a younger audience through a different medium.

For example, creating a campaign targeting Gen Xers through their preferred media that explains the “traditional” services your institution provides could result in new customers. This generation will likely need to see the same message multiple times before visiting a website or calling a phone number listed at the end of a traditional TV commercial.

Conversely, Millennials and younger are more apt to take immediate action once they trust a financial institution, which opens the door to more direct and targeted messaging. For instance, campaigns appearing on podcasts and social media around the topics of digital convenience, the ability to open an account online, or in the case of credit unions, non-profit financial status and “belonging to” or “being a member” to elicit a certain exclusivity, can re-shape their perceptions. QR codes delivered through OTT can give them the ability to open an account anytime, anywhere.

The Ideal Media Mix

Attracting Millennials — the largest demographic — and younger should be a priority for any financial institution. But ignoring older generations could prove costly.

Creating a media strategy, with appropriate messaging per audience, is an investment worth the effort.

Reach out and let’s discuss how our media buyers and strategists can build brighter financial futures.

Not just for your customers, but for your branches.